New to Financial Planning?

Let's Start With the Basics.

Financial planning isn't just for the wealthy. It's for everyone who wants to turn their income into lasting security and freedom.

Without a Plan

- ✗ Living paycheck to paycheck despite decent income

- ✗ Unsure if you're saving enough for retirement

- ✗ One emergency away from financial stress

- ✗ Buying insurance you don't understand

With a Plan

- ✓ Clear roadmap for your money and goals

- ✓ Confidence that you're on track for retirement

- ✓ Protected against life's unexpected events

- ✓ Right coverage at the right cost

Your Financial Journey in 4 Steps

Understand

Know where you are financially today

Protect

Secure yourself and loved ones first

Grow

Build wealth through smart investing

Legacy

Plan for generations ahead

Explore the Complete Guide

6-Step Process

Professional planning framework

Health Calculator

Check your financial score

Debt Management

Strategies to become debt-free

Goals

Set your vision

Cash Flow

Track money in/out

Emergency

Build safety net

Retirement

Plan your future

Legacy

Wealth transfer

Compounding

Grow exponentially

Common Misconceptions

Belief vs Reality

"I'm too young to start financial planning"

Starting early gives you the biggest advantage - compound interest works best over time. Even small amounts invested in your 20s can grow significantly by retirement.

"Financial planning is only for wealthy people"

Financial planning is about making the most of whatever you have. It's more important for those with limited resources to plan carefully to avoid costly mistakes.

"I can do it myself with online research"

Generic advice doesn't account for your specific situation - Singapore's unique CPF rules, tax reliefs, and government schemes require localized expertise.

The 6-Step Financial Planning Process

Based on the FPSB (Financial Planning Standards Board) international standards, this is the same framework used by Certified Financial Planners worldwide.

Establish Relationship

Define the scope and duration of engagement. Clarify responsibilities, competencies, and how the planner will be compensated.

- • Define services provided

- • Disclose potential conflicts

- • Clarify engagement terms

Gather Information

Collect quantitative data (income, assets, liabilities) and qualitative data (goals, risk tolerance, values, preferences).

- • Financial statements

- • Goals & priorities

- • Risk profile assessment

Analyse & Assess

Evaluate financial health using ratios and statements. Identify gaps, strengths, weaknesses, and potential threats.

- • Calculate financial ratios

- • Assess needs & priorities

- • Identify gaps & risks

Develop & Present

Develop strategies with alternatives. Present recommendations with pros, cons, risks, and time sensitivity.

- • Multiple scenarios

- • Pros & cons analysis

- • Written recommendations

Implement

Execute the agreed recommendations. Define timeline, amounts, responsibilities, and coordinate with other professionals.

- • Define action timeline

- • Assign responsibilities

- • Coordinate execution

Monitor & Review

Regular reviews to adapt to life changes, market conditions, new products, and evolving goals.

- • Annual reviews

- • Life event updates

- • Performance tracking

CFP® Professional Standard

This 6-step process is defined by the Financial Planning Standards Board (FPSB) and is the foundation of the CFP® certification.

Your 8 Key Financial Ratios

Financial planners use these 8 ratios to assess your financial health. Enter your numbers below to see where you stand.

📋 Quick Reference: 8 Financial Ratios

1. Basic Liquidity

Liquid Assets ÷ Monthly Expenses

Target: 3-6 months

2. Liquid-to-Net Worth

Liquid Assets ÷ Net Worth

Target: ≥15%

3. Savings Ratio

Monthly Savings ÷ Gross Income

Target: ≥10%

4. Debt-to-Asset

Total Debt ÷ Total Assets

Target: <50%

5. Solvency Ratio

Net Worth ÷ Total Assets

Target: ≥50%

6. Debt Service (DSR)

Debt Payments ÷ Take-home Income

Target: <35%

7. Non-Mortgage DSR

Non-Mortgage Debt ÷ Take-home Income

Target: <15%

8. Invested-to-Net Worth

Invested Assets ÷ Net Worth

Target: >50%

Chapter One

Goal Setting & Life Stage Planning

Life doesn't follow a linear path, and neither should your financial plan. Goal setting is about understanding where you are today, where you want to be, and creating a realistic path to get there.

Who This Is For

Individuals and families at different life stages, from fresh graduates starting careers to new parents balancing family needs or those approaching retirement.

Types of Financial Goals

🎯 Short-term (1-3 years)

Emergency fund, wedding, car, travel. Need liquid, low-risk solutions.

🏠 Medium-term (3-10 years)

Property down payment, children's education. Balance growth with accessibility.

🌅 Long-term (10+ years)

Retirement, legacy planning. Can afford higher risk for better returns.

🇸🇬 Singapore Context

In Singapore, life stages come with unique milestones: BTO applications, COE renewals, education planning for local or overseas universities, and CPF optimization for retirement.

💡 Pro Tips

- ✓ Review goals every 6-12 months, as priorities change when life evolves

- ✓ Focus on 2-3 priority goals at a time, not everything at once

- ✓ Write down goals and share with partner for accountability

- ✓ Build in buffer for unexpected opportunities or challenges

Chapter Two

Cash Flow & Budgeting

Cash flow is the lifeblood of your financial health. You could earn a high income but still struggle if cash flow isn't managed well. Understanding where your money goes is the first step to taking control.

Who This Is For

Individuals who earn well but feel uncertain about their progress, and anyone living paycheck to paycheck despite a good income.

The 50/30/20 Framework

50%

Needs

Housing, food, transport, utilities

30%

Wants

Lifestyle, entertainment, dining

20%

Savings

Savings, investments, debt repayment

Your Personal Budget Calculator

🇸🇬 Singapore Context

Singapore has one of the highest costs of living in Asia. Between housing loans, car expenses (COE, insurance), and lifestyle costs, even high earners can struggle. CPF contributions also significantly affect take-home pay.

💡 Pro Tips

- ✓ Pay yourself first: automate savings on payday

- ✓ Track expenses for 3 months to understand real spending patterns

- ✓ Review subscriptions quarterly. Unused ones are silent budget killers

- ✓ Use separate accounts for different purposes: daily, savings, investments, fun

Chapter Three

Emergency Fund Planning

An emergency fund is your financial shock absorber. It protects your investments from being liquidated at the wrong time and gives you options when life throws curveballs.

Who This Is For

Anyone without sufficient liquidity buffers, especially those using credit cards as emergency "funds".

How Much Do You Need?

3-6 months

Standard Recommendation

For dual-income households with stable employment

6-12 months

Higher Buffer Needed

Single income, self-employed, or volatile industries

🇸🇬 Singapore Context

Singapore has no unemployment insurance, making personal emergency funds critical. While MediSave covers some medical expenses, hospitalization deductibles can still cause significant out-of-pocket costs.

Where to Keep Your Emergency Fund

- • High-yield savings accounts: Digital banks offering 2-4% interest

- • Singapore Savings Bonds: Redeemable anytime with no penalty

- • Money market funds: Slightly higher returns, still liquid

⚠️ What's NOT an Emergency Fund:

CPF (can't withdraw), stocks (too volatile), fixed deposits (locked), credit cards (that's debt, not savings)

Financial Foundation

Debt & Credit Management

Debt isn't inherently bad - it's a tool. Used wisely, debt can help you build wealth (mortgages, education loans). Used poorly, it can trap you in a cycle of payments. Understanding the different types of debt and how to manage them is essential.

Who This Is For

Anyone with existing debt, those considering taking on debt (mortgage, car, education), or those who want to optimize their debt repayment strategy.

Types of Consumer Debt

Credit Cards

Revolving credit with daily compounding interest (typically 24-26% p.a.).

- • Pre-approved limit up to 4x monthly income

- • No fixed tenure = easy to stay in debt

- • Interest kicks in if not paid in full

⚠️ Highest cost debt - avoid carrying balances

Revolving Credit

Pre-approved credit line you can draw from repeatedly.

- • Like credit cards but separate facility

- • No fixed tenure for repayment

- • Interest compounds your balance

⚡ High risk of debt spiral

Term Loans / Instalments

Fixed repayment schedule over a set period.

- • Hire-purchase agreements

- • 0% instalment plans (often have hidden costs)

- • Personal loans with fixed tenure

✓ Predictable payments, manageable

Secured Loans

Loans backed by collateral (property, car).

- • Mortgage (home loan)

- • Car loans secured by vehicle

- • Lower interest due to collateral

✓ Good debt if asset appreciates

✓ "Good" Debt

-

•

Mortgage

Builds equity, property appreciates long-term

-

•

Education Loan

Increases earning potential

-

•

Business Loan

Generates income if business succeeds

✗ "Bad" Debt

-

•

Credit Card Balances

24%+ interest on depreciating items

-

•

Payday Loans

Extremely high interest, debt trap

-

•

Luxury Car Loans

Depreciating asset, high COE cost

🇸🇬 Singapore Debt Regulations

- TDSR (Total Debt Servicing Ratio): Max 55% of gross income for property loans

- MSR (Mortgage Servicing Ratio): Max 30% for HDB loans

- Credit Card Limits: Up to 4x monthly income (2x if income <$30K)

- Unsecured Debt Cap: Max 12x monthly income for unsecured borrowing

Debt Payoff Strategies

Avalanche Method

Mathematically optimal

Pay minimum on all debts, then put extra towards the highest interest rate debt first.

Best for: Saving the most money on interest

Snowball Method

Psychologically motivating

Pay minimum on all debts, then put extra towards the smallest balance first for quick wins.

Best for: Building momentum and motivation

💡 Pro Tips

- ✓ Balance transfer: Move high-interest debt to 0% promotional cards to save on interest

- ✓ Refinance: If rates have dropped, consider refinancing your mortgage

- ✓ Automate payments: Avoid late fees and credit score damage

- ✓ Don't just pay minimum: Credit card minimum payments can take 10+ years to clear

- ✓ Build emergency fund first: Avoid going into debt for emergencies

⚠️ Warning Signs of Debt Trouble:

- • Paying only minimum on credit cards

- • Using credit to pay other debts

- • Debt service ratio above 35%

- • No idea how much you owe

- • Avoiding looking at statements

- • Borrowing from family/friends

If you recognize these signs, consider speaking to a financial counsellor or Credit Counselling Singapore (CCS).

Chapter Four

Retirement Planning

Retirement planning ensures you can maintain your desired lifestyle when active income stops. With increasing life expectancy, retirement could last 20-30 years. The question isn't just whether you can retire, but whether you can afford to stay retired.

Who This Is For

Pre-retirees planning their next chapter, and anyone who wants to stop working someday (that's everyone!).

Key Retirement Concepts

📊 The 4% Rule

Withdraw 4% of portfolio annually. In low-interest times, 3-3.5% may be safer.

🏥 Healthcare Costs

Medical expenses typically double every 8-10 years. Plan for significantly higher costs.

📈 Inflation Impact

At 3% inflation, $5,000 today = $2,200 purchasing power in 30 years.

🇸🇬 Singapore Context

CPF provides a foundation through CPF LIFE payouts, but for most people, CPF alone is insufficient for a comfortable retirement. The Full Retirement Sum of $220,400 (2026) provides approximately $1,600 to $1,800 per month, often inadequate for desired lifestyles.

💡 Pro Tips

- ✓ Start planning 10-15 years before target retirement to maximize compounding

- ✓ Consider part-time work in early retirement to reduce portfolio withdrawal

- ✓ Do a "retirement trial run": live on projected budget for 6 months before retiring

- ✓ Build multiple income streams: CPF LIFE, investments, rental income

Chapter Five

Estate & Legacy Planning

Estate planning isn't just for the wealthy. It's for anyone who wants control over what happens to their assets and loved ones after they're gone. Without proper planning, your assets may be distributed according to laws rather than your wishes.

Who This Is For

Individuals who value clarity and control over asset distribution, especially those with dependents or significant assets.

Essential Estate Planning Tools

📜 Will

Legal document specifying how your assets should be distributed. Simple and essential.

🏛️ Trust

More control, privacy, and avoids probate. Better for complex situations.

📋 LPA

Lasting Power of Attorney: appoint someone to decide for you if you can't.

🇸🇬 Singapore Context

Singapore follows the Intestate Succession Act for non-Muslims. Without a will, your estate follows fixed rules that may not match your intentions. CPF and insurance pass by nomination, NOT by will. Ensure these are aligned!

💡 Pro Tips

- ✓ Update your will after major life events such as marriage, divorce, or childbirth

- ✓ Create an LPA before you need it. You can't after losing mental capacity

- ✓ Keep a list of all assets and locations for your executor

- ✓ Review CPF and insurance nominations annually

Chapter Six

The Power of Compounding

The power of compound interest is often called the eighth wonder of the world. This chapter demonstrates why starting early, even with smaller amounts, can result in more wealth than starting later with larger investments.

The Rule of 72

Divide 72 by your annual return rate to estimate how many years to double your money. At 8% returns, your money doubles every 9 years.

See Your Money Double

At this rate, your money doubles every

Starting with $5,000 at age 30, you could have $640,000 by age 93

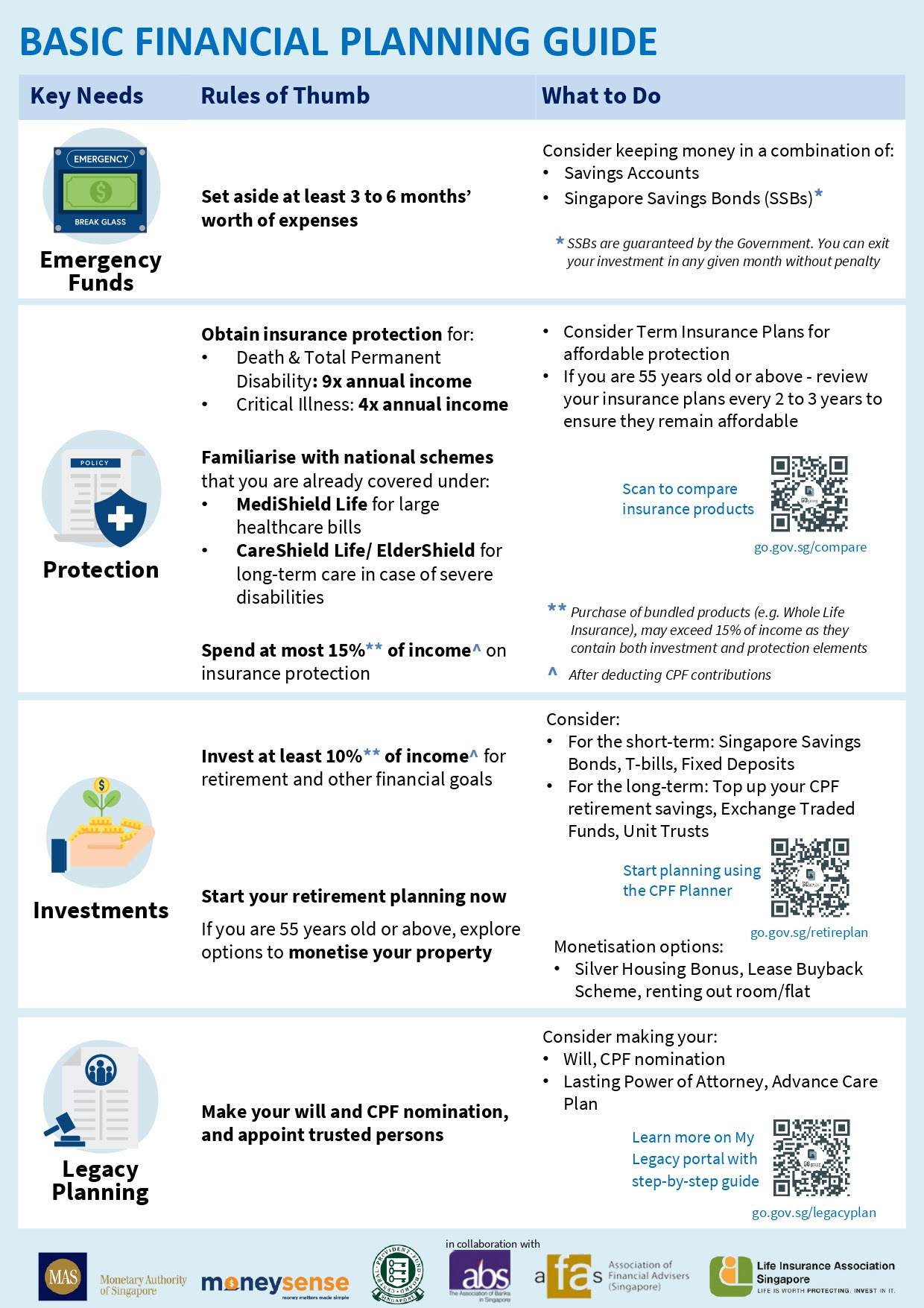

The Basic Financial Planning Guide

Developed by MAS, MoneySense, CPF Board, and industry associations to help everyone in Singapore (Citizens, PRs, and Work Pass holders) plan their finances at every life stage.

📄 Official guide by MoneySense & MAS

Why This Guide Matters for Everyone in Singapore

Official Government Framework

Endorsed by MAS and developed with CPF Board, ABS, AFA, and LIA to provide trusted, unbiased guidance.

Life Stage Specific

Tailored advice for young adults, families, sandwich generation, pre-retirees, and retirees.

Clear Rules of Thumb

Simple benchmarks for savings, insurance, and investments that anyone can follow.

📋 Key Financial Planning Guidelines

Emergency Fund

3-6 months

of expenses set aside for emergencies

Death & TPD Cover

9x Income

to protect your dependants

Critical Illness

4x Income

coverage for major illnesses

Investments

≥10%

of income for retirement goals

Insurance Budget Rule: ≤15% of Income

According to the guide, spend at most 15% of your income on insurance protection. This ensures you have enough for savings and investments while staying adequately protected.

Source: MoneySense.gov.sg | A Singapore Government initiative by MAS

Two Friends, Same Goal: Who Wins?

Both invest $1,000/year at 8% returns. But one secret changes everything...

Chapter 1

Meet the Early Bird & the Late Starter

Early Bird

The Wise One

Starts investing at Year 1

Invests $1,000/year for 10 years

Then stops completely and just watches

Late Starter

The Procrastinator

Waits until Year 11 to start

Invests $1,000/year for 20 years

Never stops and keeps going strong

Quick! Who has more at Year 30?

Chapter 2

Fast Forward 30 Years...

Early Bird

Invested $10,000 total

Final Value at Year 30

$72,922

Late Starter

Invested $20,000 total

Final Value at Year 30

$49,422

+$23,500 More!

Despite investing half the money, Early Bird ends up with 47% more wealth.

$10K

Less invested

$23.5K

More wealth

10 yrs

Head start

Chapter 3

The Secret Behind the Numbers

It's Not About the Money. It's About Time

Early Bird's first $1,000 had 30 years to compound. Late Starter's first $1,000 only had 20 years. That 10-year head start is worth more than $10,000 of extra contributions.

Time in the market

beats timing the market

Start small, start early

beats start big, start late

Every year you wait costs you exponentially.

Chapter 4

Now Try It Yourself

Adjust the numbers below and see how different scenarios play out over time.

Your Inputs

Results

Early Bird

Invested: $10,000

$72,922

ROI: 629%

Late Starter

Invested: $20,000

$49,422

ROI: 147%

Early Bird Advantage

Despite investing $10,000 less!

+$23,500

Growth Over Time

Why Individuals Choose Us Over

Other Financial Advisors

Not all financial advice is created equal. Here's what sets us apart.

MAS Licensed

Fully regulated by the Monetary Authority of Singapore

5.0 Rating

Trusted by hundreds of satisfied individuals

CFP® Qualified

Certified Financial Planner with advanced training

Ready to Take Control of

Your Financial Future?

Join hundreds of Singaporeans who've built lasting wealth with personalized guidance. Your journey starts with a simple conversation.